Diving into the Dynamic RTH Gap [Pro+] With The Engineer (@The_IAO_) + The Deceiver Model Showcase

What is the RTH gap, why is it so important?

Hello everyone,

Today I am joined by my fellow trader The Engineer, if you don’t follow him already, make sure to give him a follow here on X.

In this article we are going to explore the regular trading hours, and the RTH gap that comes with it in the futures market.

“I had a paradigm shift, once I was introduced to the RTH“

Now tell me, what is this gap?

Every day at 16:15 New York local time, the stock market closes, and at 09:30 the next morning the doors of the stock markets open again. Does that mean trading stops at 16:15 and resumes at 09:30? No, it doesn’t actually. After 16:15 electronic trading continues until 5pm, at 5pm we have a 1-hour break and resume again at 6pm. The electronic trading hours are 23 hours a day in that sense.

Now, everything in between 16:15 and 09:30 is called Electronic Trading Hours (ETH)

The trading period between 09:30 and 16:15 is called Regular Trading Hours (RTH)

Now, we can imagine that the price will fluctuate when the stock markets are closed, an when they open again the next day, we might be at a higher or lower price level relative to where we closed the previous day at 16:15. Let’s say we close at a price 19000, and open at 19200, that means we have a gap of 200 points.

We call this gap, the RTH Gap, or Opening Range Gap. In the 2023 mentorship episode “One Trading Setup For Life“ ICT showcases a time based framework built around utilizing this gap. Watch it here

My friend The Engineer, created a framework and trading model based on this episode. Together with Toodegrees, he created an indicator that visualizes all the components that we need to trade this very model: Dynamic RTH Gap [Pro+].

What this tool does, it plots the RTH gap on the chart along with a number of additional features, like standard deviations of the gap, previous gaps, differentiating the RTH vs ETH candlesticks on your chart, and even more.

Now, how do we trade this? How can we build a framework around this?

Well, lets take a look at the theoretical side behind this model.

As we know, smart money will look to position themselves at the best price they can get. That means, in deep discount when they are looking to buy, and in deep premium when they are looking to sell.

Let’s say, we are expecting an expansion higher the upcoming trading day. When the market opens at 09:30 we will be looking to position ourselves below the 09:30 open price, because that is discounted relative to the opening price. That way we are aligned with smart money.

Now, how does that practically look on the charts?

The Engineer’s Trade Breakdown:

The Engineer:

The tool has the option to automatically change the candle colors of the overnight price action, this way you can identify overnight liquidity. It also allows me to see the direction of the overnight price action, helping me to determine where I want to position myself relative to pre-market trading.

The table shows you what percentage of the gaps from the last few days remain open and the size of these gaps. This helps you anticipate certain scenarios, as Michael mentioned in his latest videos, when we have a gap greater than 40 handles, there is a high probability of rebalancing at least 50%.

Given that the Consequent Encroachment is considered and seen as fair value, this is an area where I look to take partials.

A Sign Of Time:

What do you do before the session starts? What is your routine in terms of marking your charts?

The Engineer:

Before the session starts, I identify where we are in relation to the previous RTH close, in order to anticipate where we will open and the type of gap we get during the market open (bullish vs bearish gap)

The Deceiver Model

A Sign Of Time:

So to trade this, I could imagine you have your A+ setup right? Like your bread and butter setup.

The Engineer:

Yes, I have a specific model that I trade, it’s called The Deceiver Model

A Sign Of Time:

The Deceiver Model, that sounds very cool, any reason you chose that name specifically?

The Engineer:

It’s because it fools everyone who’s not aware of this gap, and it’s logic.

It is a time based model, a detailed framework around the RTH Gap.

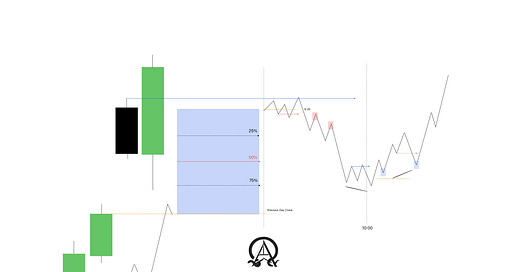

This the schematic of the model.

As you can see it’s a detailed view on how to approach the RTH gap and apply the Market Maker Model framework.

Note that this is just the introduction to the model, I have very specific elements that I am going to implement. A full document showcasing everything will release soon! - The Engineer

How do I get access to the Dynamic RTH Gap [Pro+] indicator?

You can find it here: Dynamic RTH Gap [Pro+]

Where do I learn more about The Deceiver Model?

You can find a lot of information on The Engineer’s Youtube channel

and on his X Page